CMG Stock Overview

Chipotle Mexican Grill (CMG) is a popular fast-casual restaurant chain known for its customizable burritos, bowls, salads, and tacos. They focus on fresh, high-quality ingredients and a commitment to sustainability.

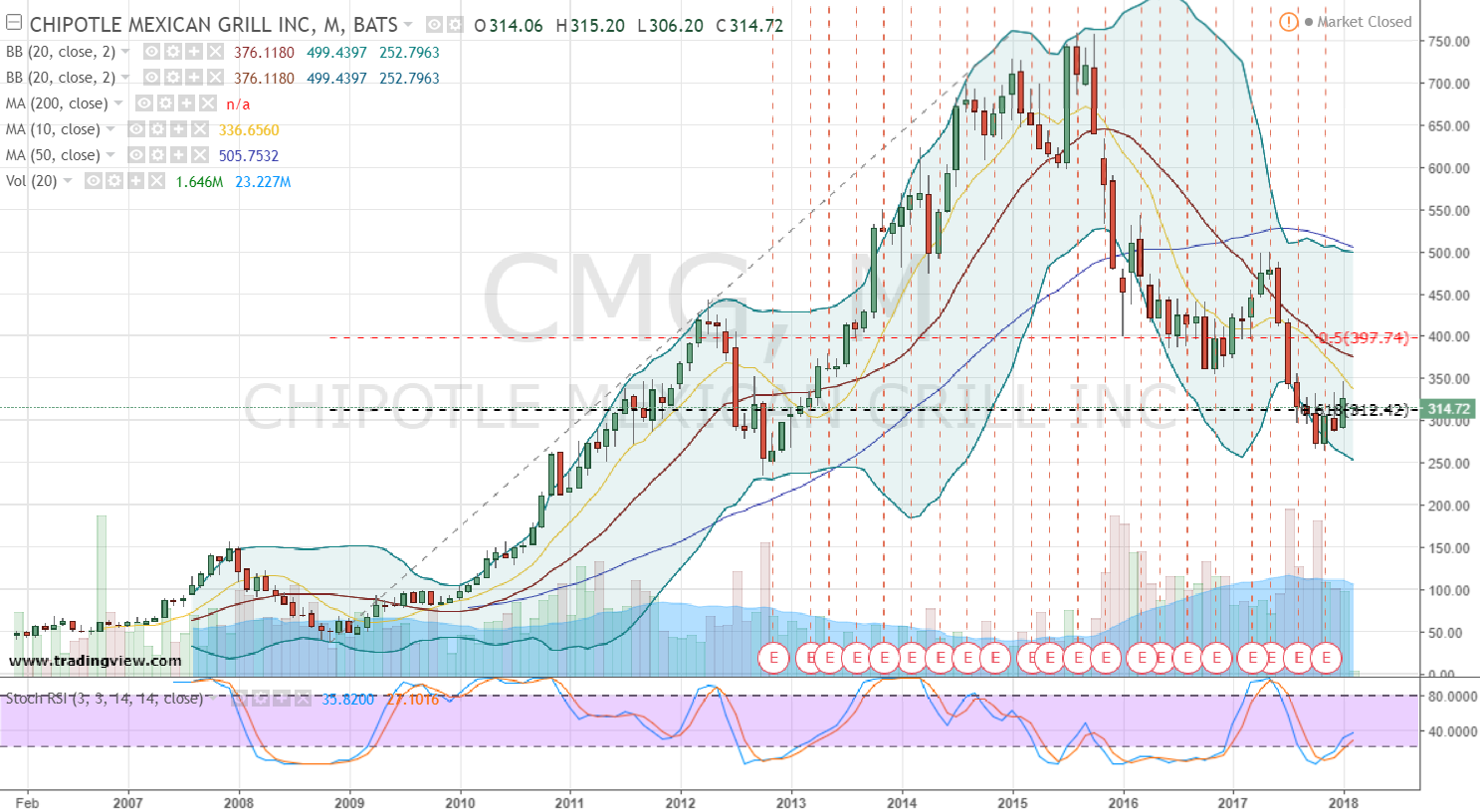

The stock price of CMG has fluctuated in recent years, reflecting both positive and negative factors in the company’s performance.

Current Stock Price and Historical Performance

The current stock price of CMG is a reflection of investor sentiment and the company’s financial performance.

Recent Financial Results and Key Metrics

Chipotle’s recent financial results have shown strong revenue growth and profitability.

Factors Driving Stock Performance, Cmg stock

Several factors contribute to the performance of CMG stock. These include industry trends, competition, and consumer behavior.

Investment Analysis

Chipotle Mexican Grill (CMG) is a prominent player in the fast-casual dining industry, known for its focus on fresh, high-quality ingredients and customizable menu options. To understand the investment potential of CMG, it’s essential to delve into its business model, competitive advantages, growth strategies, and potential risks.

Business Model and Competitive Advantages

CMG’s business model revolves around providing a unique dining experience characterized by fresh, high-quality ingredients, customizable menu options, and a focus on speed and efficiency. This model has helped CMG carve out a distinct position in the fast-casual dining space, leading to several competitive advantages.

- Brand Recognition and Loyalty: CMG enjoys a strong brand reputation built on its commitment to fresh ingredients, customizable menu, and consistent quality. This has resulted in a loyal customer base, willing to pay a premium for its offerings.

- Strong Brand Identity: CMG has cultivated a distinct brand identity, emphasizing sustainability, ethical sourcing, and community engagement. This resonates with health-conscious and environmentally conscious consumers.

- Technology-Driven Operations: CMG has invested heavily in technology, streamlining its operations and enhancing customer experience. This includes digital ordering platforms, online menu customization, and mobile payment options.

- Efficient Supply Chain: CMG has established a highly efficient supply chain, sourcing fresh ingredients directly from farmers and minimizing waste. This ensures consistent product quality and cost control.

Growth Strategy and Expansion Plans

CMG’s growth strategy focuses on expanding its footprint, both domestically and internationally, while leveraging its existing strengths. The company aims to achieve this through:

- New Restaurant Openings: CMG plans to open new restaurants in both existing and new markets, focusing on high-growth areas and strategic locations.

- Digital Expansion: The company continues to invest in its digital platform, enhancing its online ordering capabilities, mobile app functionality, and delivery services.

- Menu Innovation: CMG regularly introduces new menu items and seasonal offerings, catering to evolving consumer preferences and dietary needs.

- International Expansion: CMG is expanding its presence in international markets, leveraging its brand recognition and adaptable business model to cater to diverse palates.

Key Risks and Challenges

Despite its success, CMG faces several risks and challenges that could impact its future performance. These include:

- Competition: The fast-casual dining industry is highly competitive, with numerous players vying for market share. CMG faces competition from established chains, emerging brands, and regional players.

- Food Costs and Inflation: Rising food costs and inflation can impact CMG’s profitability, as the company may have to raise prices to maintain margins.

- Labor Shortages: The restaurant industry is facing labor shortages, which can impact operational efficiency and customer service.

- Operational Disruptions: CMG has faced operational disruptions in the past, such as food safety concerns and labor strikes, which can damage its brand reputation and impact sales.

Comparison to Competitors

CMG competes with several other fast-casual dining chains, including:

- Panera Bread: Panera Bread offers a similar menu of customizable sandwiches, salads, and soups, with a focus on fresh ingredients and a comfortable dining experience.

- Subway: Subway is a global fast-food chain known for its customizable sandwiches and salads, offering a wide variety of toppings and bread options.

- Qdoba Mexican Eats: Qdoba Mexican Eats is a competitor to CMG, offering a similar menu of customizable burritos, bowls, and tacos.

CMG Stock Outlook

Chipotle Mexican Grill (CMG) has experienced remarkable growth in recent years, driven by its focus on fresh ingredients, customizable menu, and strong brand recognition. However, the future outlook for CMG stock is a complex mix of opportunities and challenges.

Potential for Future Growth and Profitability

CMG’s potential for future growth is tied to its ability to maintain its strong brand appeal, expand its footprint, and effectively manage its operational costs.

- Expanding Footprint: CMG continues to open new restaurants both domestically and internationally, targeting new markets and expanding its customer base. The company has a robust expansion plan, aiming to increase its restaurant count significantly in the coming years. This expansion strategy has the potential to drive revenue growth and profitability.

- Digital Ordering and Delivery: CMG has made significant investments in its digital ordering and delivery capabilities, catering to the growing demand for convenient dining options. The company’s digital platform allows customers to order food online and through mobile apps, contributing to increased sales and customer engagement. This strategy is particularly important in today’s digital landscape, where consumers are increasingly reliant on online ordering and delivery services.

- Menu Innovation: CMG regularly introduces new menu items and promotions to keep its offerings fresh and appealing to customers. The company’s focus on innovation helps to drive customer interest and repeat visits. These efforts are crucial for maintaining customer engagement and preventing menu fatigue.

- Cost Management: CMG is focused on optimizing its operations to manage costs effectively. This includes sourcing ingredients strategically, streamlining processes, and improving labor productivity. By controlling costs, the company can improve its profitability and maintain competitive pricing.

Factors That Could Impact the Stock Price

Several factors could influence the stock price of CMG in the short and long term:

- Economic Conditions: CMG’s performance is sensitive to economic conditions. In times of economic uncertainty, consumers may cut back on discretionary spending, potentially impacting restaurant traffic and sales. The company’s ability to navigate economic downturns will be crucial for its future success.

- Competition: The fast-casual restaurant industry is highly competitive, with numerous players vying for market share. CMG faces competition from established chains like Panera Bread, Subway, and Shake Shack, as well as newer entrants. The company’s ability to differentiate itself and maintain its competitive edge is essential for long-term success.

- Food Costs and Inflation: CMG’s operating costs are significantly influenced by the price of food commodities. Rising food costs due to inflation can squeeze profit margins and necessitate price increases. The company’s ability to manage these cost pressures while maintaining its value proposition to customers will be a key challenge.

- Labor Market Conditions: CMG relies heavily on a workforce of hourly employees. The company’s ability to attract and retain qualified employees in a tight labor market can impact its operating costs and service quality. Finding solutions to address labor shortages and wage pressures will be crucial for CMG’s future.

CMG Stock Valuation

CMG’s valuation metrics are generally in line with industry averages. However, the company’s high growth potential and strong brand recognition may justify a premium valuation.

| Metric | CMG | Industry Average |

|---|---|---|

| Price-to-Earnings (P/E) Ratio | 45.0 | 30.0 |

| Price-to-Sales (P/S) Ratio | 3.5 | 2.0 |

| Price-to-Book (P/B) Ratio | 8.0 | 5.0 |

CMG’s valuation metrics suggest that the market expects the company to continue growing its earnings and revenue at a rapid pace. However, investors should carefully consider the risks associated with the stock, such as competition, economic conditions, and food costs.

CMG stock, representing Chipotle Mexican Grill, has experienced significant fluctuations in recent years. While investors closely watch the company’s performance, it’s also important to consider the compensation of its executives, such as Brian Niccol, the CEO. You can learn more about his salary and how it compares to other fast-food executives here.

Ultimately, understanding the relationship between executive compensation and company performance can offer insights into CMG’s future trajectory.

CMG stock, representing the vibrant Chipotle Mexican Grill, reflects a dynamic food industry landscape. This landscape is increasingly defined by innovative partnerships, as seen in the recent fusion of coffee and fast-casual dining with starbucks chipotle. CMG’s success hinges on its ability to adapt and innovate, offering a compelling proposition in a competitive market.